Don’t miss out on your chance to save money with these powerful IRA tax benefits for the 2015 tax year

The IRS has started accepting federal income tax returns and the 2015 tax season is in full swing. It’s too late to get many of the deductions and credits that you might have missed but there are still some huge IRA tax benefits you can claim on your 2015 taxes.

That’s because you have until the last day to file your taxes, April 18th, to contribute to many types of retirement accounts. Some of these will save you money now while others will give you tax-free money in retirement.

What are the IRA tax deadlines and contribution limits for 2015?

You have until you file or until April 18th to contribute to your traditional IRA, Roth IRA, Health Savings Account (HSA), SEP-IRA or solo 401k. The deadline for filing your income taxes has been moved back this year for the observance of Emancipation Day in the District of Colombia on the 15th. You’ll get a few more days to get your taxes done and Maine or Massachusetts residents get an extra day for observance of Patriots Day on the 18th.

If you are also covered by an employer-sponsored retirement plan, your 2015 IRA contribution deduction starts to decrease once you make $61,000 in modified adjusted gross income (AGI) or $98,000 for those filing jointly. If you are not covered by an employer-sponsored plan, your IRA contribution deductions are only limited if your spouse is covered by a plan at work and then only if you make $184,000 or more for the year.

Sluggish inflation kept the contribution limits for 2015 and 2016 at exactly the same point, up to $5,500 or up to $6,500 if you’re age 50 or older. The contribution limit doesn’t apply to 401k rollovers or qualified reservist repayments so take advantage of any rollover from a 401k.

Roth IRA contributions start to phase out once you make over $116,000 filing separately or beyond $183,000 in modified AGI if you’re filing jointly. You can still do a rollover from a traditional IRA into a Roth, called a back door Roth.

How much are IRA tax benefits worth?

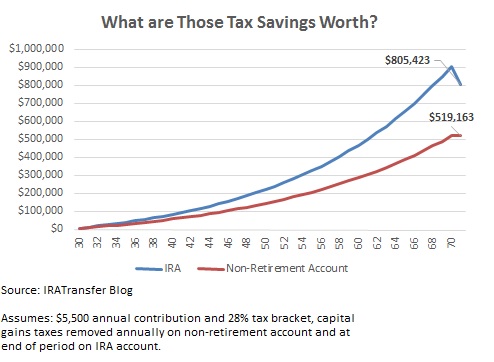

As tough as it is to earn a decent return on investments, you can’t afford to be missing out on free money when you can get it. By contributing to a traditional IRA, you can deduct the contribution from your income and get tax-deferred growth until you withdraw the money. That’s a powerful tax savings now and for the next several decades.

In fact, assuming annual contributions of $5,500 and a 28% tax bracket, you could be missing out on nearly $300,000 if you aren’t taking advantage of IRA tax benefits. The graphic below shows the ending account value of an IRA and a non-retirement account. Capital gains taxes are taken annually out of the non-retirement portfolio and at the end of the period for the IRA account.

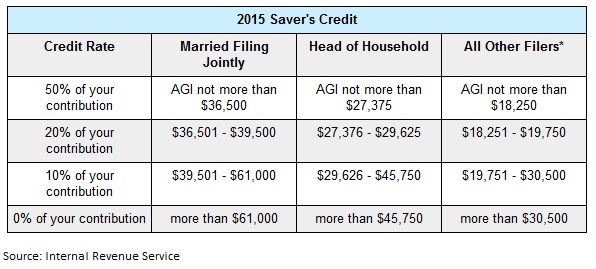

You might even be entitled to an even bigger tax break on your retirement contributions. The Retirement Saver’s Credit gives you a full credit of up to $2,000 per taxpayer against their taxes. If you make less than $36,500 and file jointly, you can take half of your retirement contributions as a credit against any income taxes owed. The credit starts phasing out from there but you can make up to $61,000 and still get a partial credit.

Contributing to your IRA and other retirement accounts offers some of the best tax benefits you’ll ever find. Don’t miss your chance to take advantage of these IRA tax benefits on your 2015 income taxes.