As 2 ounce coins have become very popular, many dealers are charging as much as 65% above the fair market value (FMV).

Unscrupulous dealers have been found to be charging over 90 dollars for coinage that can be acquired for just under 65 dollars.

The dealers selling them around 100 dollars or better say it’s fair because of the law of supply and demand but others including myself say they are taking advantage of investors simply because the coins are difficult to acquire after the year of mintage.

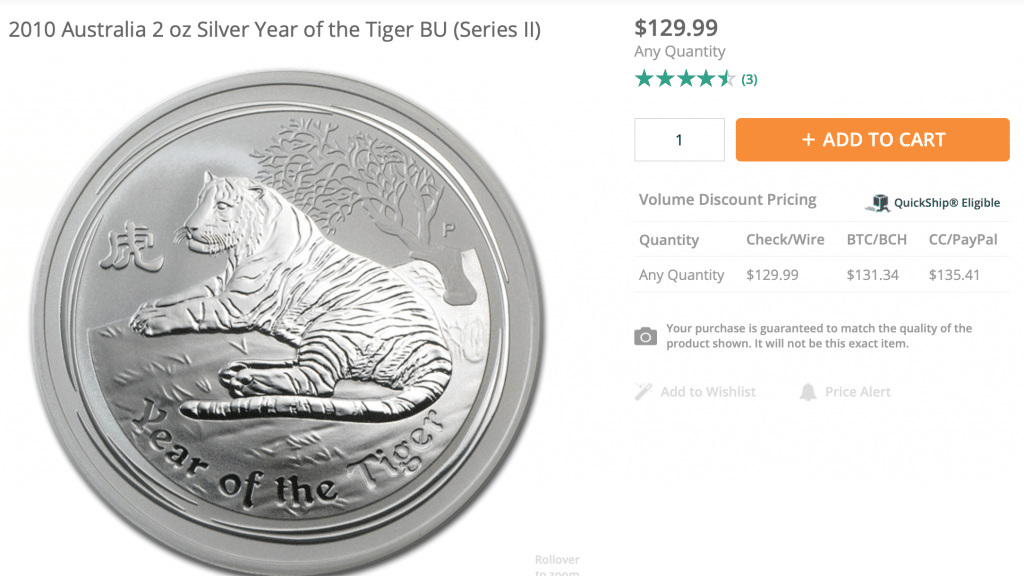

So why are coins like the 2 ounce Australia Year of the Tiger and the Royal Canadian Mints Orca coins so popular in the first place?

- Because popular one ounce silver coins have been massively counterfeited by the Chinese in recent years.

- The RMC 2 ounce coins have anti-counterfeit protection that is built right into the coin.

- Most 2 ounce coins like the Wildlife series are produced for only one year, so they have much lower mintages than coins produced multiple years.

- These 2 ounce coins are generally released to the public through exclusive offerings, making them much harder for the general public to acquire.

- The coins have some collectability that could make them much more valuable than the underlying metal content in the future.

- Most 2 ounce coinage have higher metal purity .9999 vs .999 for coins like the American Eagle.

- Because of their high purity 2 ounce silver coins from reputable mints are eligible for inside your IRA or 401k account.

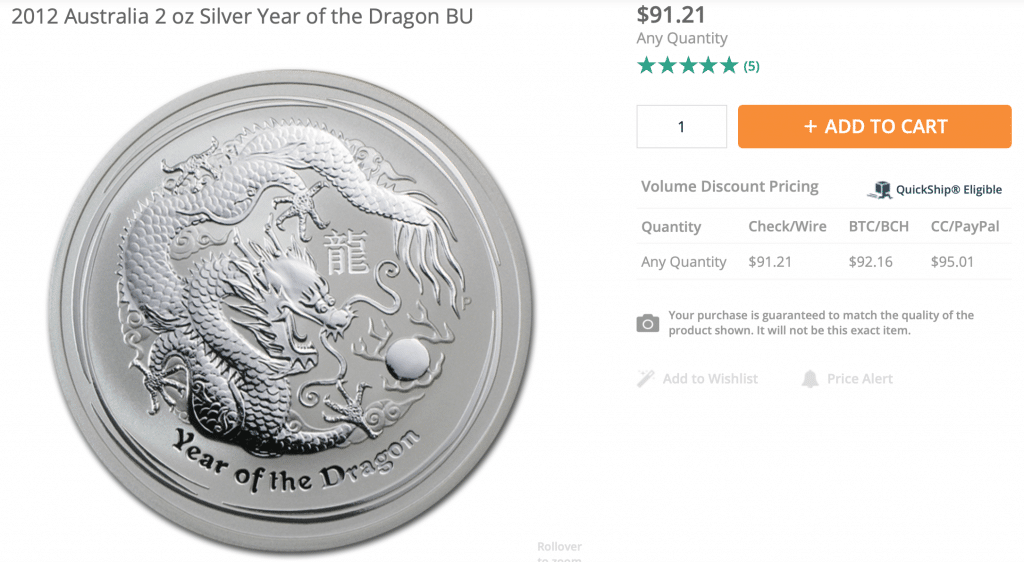

Here are a few examples of dealers fleecing the public on some very popular two 2 ounce coins from reputable mints.

In conclusion. Savvy investors would not pay 100 dollars for coins that can be bought on discount exchanges for 65 dollars. However sometimes collectors or investors want something so bad that they are willing to pay a mark up like coins that are sold on Ebay or Amazon.com independent sellers market place. My recommendation is to hold off on buying until you can get them at fair market value FMV or an exclusive seller.

Written by Tallahassee Florida coin expert David Cromwell

This is a guest blog post from an independent source. This information does not represent the views of iratransfer.com To submit a guest blog for consideration please send to info@iratransfer.com We will reply within 48 hours to accept or decline and we only consider guest post that have investment or retirement topics.