You can either rollover or transfer your funds into a new retirement account, and knowing the difference between these two distribution methods is crucial for the safety of your nest egg. A couple of wrong moves and you could be out thousands of dollars, or more.

Definition of IRA Rollover vs Transfer

Many people wrongfully believe the terms “rollover” and “transfer” are interchangeable. While they both concern moving funds from one account to another, the process differs enormously.

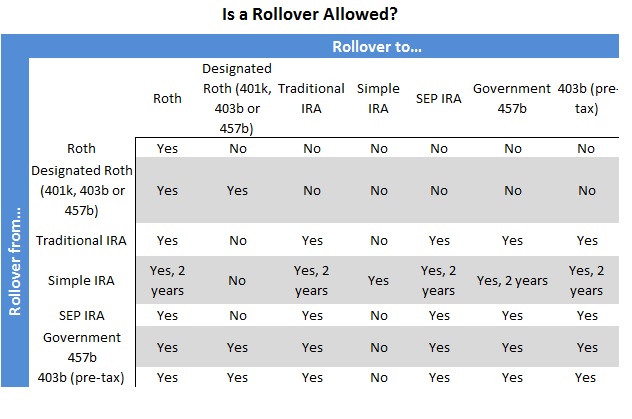

A rollover occurs when funds from one retirement account (typically under your current or former employer, but not in all cases) are relocated to a retirement account of a different type. Examples include 401k to traditional IRA or 401k to Roth IRA transactions. Rollovers can only be made once every 365 days, and you must notify the IRS.

A transfer occurs when funds from one retirement account are relocated to a new retirement account of the same type. This includes 401k to 401k, a traditional IRA transfer to traditional IRA, and Roth IRA transfer to Roth IRA transactions. Transfers can be conducted as many times as one likes during the year, and the IRS does not have to be notified.

If you get laid off and want to move your 401k to an IRA, it requires a 401k rollover. On the other hand, if you’re switching to a new employer and want to move your 401k to your new employer’s 401k, it requires a transfer. Likewise, if you want to relocate funds from your current traditional IRA to a new traditional IRA, that’s also a transfer rather than a rollover.

How IRA Rollovers Work

How IRA Rollovers Work

A slew of information exists regarding tax implications and the process of rolling over funds. It’s recommended that you talk to your tax adviser before undergoing this process. But, in the meantime, let’s discuss the basics.

When funds are rolled over, a check is made out from the administrator of the account to the recipient (unless it’s a direct transfer, which will be discussed later). The IRS deems this payout as taxable income and requires administrators to withhold 20%. You then have 60 days to re-invest the remaining funds into a new retirement account.

If you miss the 60-day deadline, the IRS keeps the 20% that was withheld from your distribution. They may also withhold an extra 10% if you conducted the rollover before the age of 59.5 (an early-withdrawal penalty). If these guidelines are not adhered to, individuals can potentially lose thousands of dollars.

The good news: Once you return those funds to an eligible retirement account within 60 days, the IRS will reimburse the amount that was withheld when you file your taxes. However, you must cover the full amount. If your 401k had $8,000 in it and you received $6,400 because 20% was withheld, you have to come up with the $1,600 when re-investing the money into a new retirement account. Only then will the IRS reimburse those funds.

How IRA Transfers Work

Transfers are more straightforward than rollovers.

To conduct a transfer, ask your administrator to send the funds straight to another retirement account. This new account must be of the same type as your previous one (401k to 401k, IRA to IRA).

However, you never gain control of the funds during a transfer. They are not distributed to you personally. This is typically known as a “trustee to trustee” or custodial transfer. As such, the IRS does not consider the funds taxable income and never touches them. Transfers act as a hassle-free way to relocate funds when the same account types are involved and there’s no need to take delivery of the funds before they go into another account.

It’s important to note, even though you never gain control of the funds, your administrator may write you a check made payable to [the new administrator] + [FBO] + [your name]. FBO stand for “for the benefit of.” You cannot cash this check and it must be sent directly to the new administrator. This is still considered a transfer, not a rollover.

Direct IRA Rollovers vs Transfer

To make matters slightly more complicated (but not overwhelmingly so), there are two types of rollovers; direct and indirect.

Direct rollovers act like transfers, in that the money never touches your hands. However, unlike transfers, they occur between retirement accounts of different types. You must report a rollover to the IRS, whether you’re conducting a direct or indirect rollover.

Indirect IRA Rollovers

Indirect rollovers come with the tax implications. They occur between retirement accounts of different types, but your administrator cashes out your account and hands you a check with the amount required by the IRS withheld. This amount differs whether you’re rolling over from a 401k or an IRA.

If you’re rolling over from a 401k, 20% of the total will be withheld. If you’re rolling over from an IRA, 10% will be withheld. To reiterate, you are responsible for coming up with the amount of the withholding when re-investing your funds. Only then will the IRS reimburse you at tax time.

Critical Questions for IRA Rollovers vs Transfers

Of course, you can always leave the funds in your previous employer’s 401k. However, if less than $5,000 exists, some 401k plans may automatically empty the account. Contact your administrator as soon as possible to attain these funds.

If you’re age 55 or older and lose your job, the IRS allows you to make withdrawals from your 401k without being charged an early-withdrawal penalty. IRAs do not allow you to do this, but you cannot add to your 401k once your employment is terminated.

This information is not exhaustive. However, it does provide a strong basis for handling those precious retirement funds. Make sure to contact your tax supervisor for further information or contact Janguard for free, personalized assistance. Alternatively, you can call Janguard directly at 800.571.6341 today for an obligation-free portfolio evaluation as well as recommendations on how you can better secure your financial independence with an IRA transfer.

How IRA Rollovers Work

How IRA Rollovers Work