A Roth IRA conversion could be one of the best retirement planning decisions you make

Most people think a Roth IRA conversion is simply a matter of estimating your taxes in retirement. Besides the benefit to those with higher future tax rates, there are several other reasons why you should consider converting some of your retirement accounts to Roth savings plans.

In fact, there’s one reason that everyone should take advantage of a Roth IRA conversion.

When Does a Roth IRA Conversion Make Sense

The general thinking is that a Roth IRA conversion makes sense if you think your income taxes might be higher during retirement. Since you pay income taxes on your Roth IRA deposits now, you are able to withdraw it tax-free in retirement.

Being able to take an immediate deduction on your taxes now rather than in the future is persuasive and a lot of people do not spend much time thinking about the benefits of a Roth conversion. This kind of thinking could cost you tens of thousands and more in retirement, especially if your income tax rate increases.

It’s a good idea to take a look at your source of income, those you collect now and those that you might collect in the future. If you run your own business or have some ownership in one, a Roth conversion usually makes sense. Your income from the business could grow quickly and mean that you end up paying much more in taxes later in life than you do now.

If you do decide to convert to a Roth IRA, you will owe taxes on your deposit as income for the current year. This takes a little planning to either save our enough money to pay the tax obligation when it comes around or make sure you have enough savings that you can pay the taxes without reducing the amount you deposit in the Roth IRA.

Don’t forget to keep your Roth conversion or deposits in the account for at least five years before withdrawing the money to avoid penalties. Distributions from a Roth IRA are tax-free and penalty-free as long as the money has been in the account for more than five years and you meet one of the following conditions.

- You are 59 ½ years or older

- You pass away or become disabled

- You want to make a first-time home purchase

Besides the benefit to retirement taxes, you aren’t required to start withdrawing money from your account when you reach 70 ½ years old. The IRS requires minimum distributions from traditional IRA plans depending on a calculation of the account balance and estimates for your life span. Put a lot away in these traditional IRA accounts and you could find your tax bill jumping on mandatory withdrawals.

Not only can you keep your money in a Roth IRA for as long as you like but you can pass it to heirs completely tax-free. At that point, it becomes a powerful estate planning strategy as well.

Why Everyone Should Convert to a Roth IRA

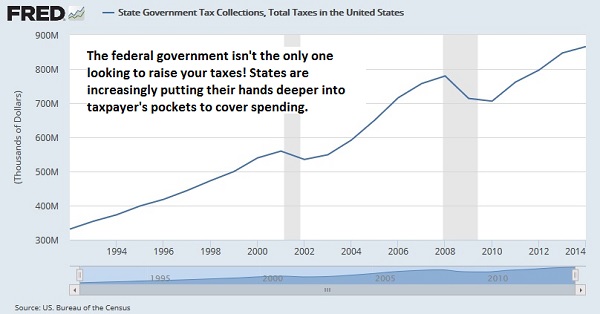

There is one reason why everyone should convert some retirement money into a Roth IRA. We watch the federal deficit and booming debt regularly, watching the fiscal health of our nation die a slow death, but the states are also increasingly reaching into taxpayer’s pockets.

The fact is that nobody can know for certain what tax rates will be like in the future. There is an extremely strong likelihood that they’ll be higher for everyone as governments, both federal and local, look to cover runaway spending.

Besides trying to forecast tax rates ten or twenty years into the future, you never know what lies ahead for your own financial fortune. You work hard and might just enjoy a fairly strong income from your investments and business in retirement. Those traditional IRA and 401k withdrawals will be taxed as income and you could be paying more than you expected.

The only way to really plan for your lowest tax liability in retirement is to diversify your retirement accounts into tax-free and tax-deferred plans. This means converting some of your money to a Roth IRA account from which you’ll enjoy tax-free withdrawals in retirement. Don’t forget, you can also convert assets from old 401k accounts through a Roth 401k rollover.