Take advantage of great tax benefits through retirement planning with this guide to Roth IRA accounts

Roth IRA accounts are less well known than traditional accounts or 401(k)s managed by your employer. That doesn’t mean that they are any less valuable as a part of your retirement savings plan. In fact, several benefits to the Roth IRA account could make it your most valuable asset for retirement income and avoiding high tax bills. Know the facts and take advantage of different opportunities across your savings options.

I’ve got a portfolio, why do I need a Roth IRA retirement account?

Whether you’re 15 or 50, everyone needs a retirement account. Your portfolio of investments may help you save for financial goals and living expenses after you retire but there are still some very important reasons to open an account specifically designed to help save for retirement.

First, retirement accounts are going to provide some huge tax benefits. Whether you get a tax deduction on current contributions to a traditional IRA or you get tax-free withdrawals with a Roth IRA, you are going to be saving a lot of money by putting some money in a retirement account.

Another benefit of retirement accounts that most people overlook is the discipline they force on investors. You are much less likely to “gamble” with retirement savings by day-trading stocks or investing in the next hot thing on Wall Street. Retirement assets are generally held in safer assets and investments are held long-term, reducing fees and the risk of panic-selling.

What is a Roth IRA?

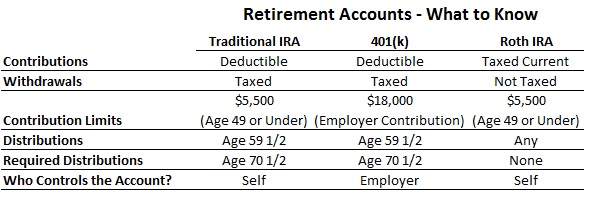

A Roth IRA is an individual retirement account that can provide tax-free income in retirement. While contributions to a traditional IRA are deductible on your current taxes, you still pay taxes on your Roth IRA contributions but do not have taxes due on withdrawals. On a traditional IRA, you’ll pay taxes on contributions and earnings during retirement. The benefit to Roth IRAs is that any earnings on your account are completely tax-free when withdrawn.

As with the traditional IRA, you can contribute to your Roth IRA up to April 15th for prior year’s contributions.

Roth versus Traditional IRA

Most people talk about the Roth and traditional IRA options as if it were an either-or scenario. Unless you’ve got a crystal ball into the future, your best bet is to have both accounts.

Holding money in both a Roth IRA and a traditional IRA account is a great way to diversify your tax risk in retirement. Your tax bill is likely relatively high now in your earning years, making it a given that you would want the immediate deduction benefit of a traditional IRA.

But no one knows what taxes are going to be like in the future, especially with the precarious situation of social security and national debt. Many people may be surprised when they see their tax bill rising even in retirement. For this reason, you really need to take advantage of the tax-free withdrawals you will enjoy in a Roth IRA.

Roth IRA accounts can also provide access to cash in emergency situations

. Most financial planners recommend you hold at least six months of emergency expenses in a savings account. How many actually do this? A report by Bankrate shows that 42% of Americans have more credit card debt than emergency savings or no emergency savings at all. While it’s not recommended, Roth IRA contributions can be withdrawn without penalty before you are 59 ½, though you will still pay taxes if you withdraw any earnings.

While traditional IRA accounts require you to start withdrawing money after age 70, Roth IRAs do not require distributions and you can continue putting money into your account. If you’re still working and able to contribute, you should have that opportunity and not have someone telling you when to retire.

Your Roth IRA could turn out to be a powerful estate planning tool as well. Since you already paid taxes on the contributions, your heirs may not have to pay taxes on distributions from the account if received in an estate. With the government continuously looking to the estate tax to plug holes in the budget, this benefit of the Roth IRA could be one of the biggest.

Even with the immediate tax benefit of the traditional IRA, the Roth IRA may provide greater savings over the long-run. Since you are not required to begin withdrawals by a certain date and enjoy the tax benefit on earnings as well as contributions, Roth IRAs should be a part of everyone’s retirement planning.

Who is Eligible to Contribute to a Roth IRA?

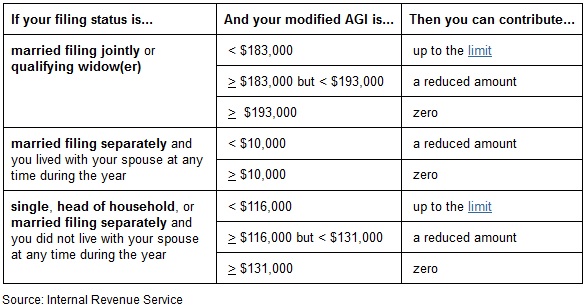

The contribution limits to a Roth IRA are the same as with a traditional IRA, up to $5,500 a year or higher if you are within catch-up rules. There are limits to who can contribute to a Roth IRA, dependent on your modified adjusted gross income. You can contribute up to the limit only if your modified AGI is less than $116,000 for individual filers or up to $183,000 for married filers. Roth IRA income eligibility limits are not affected by coverage by an employer retirement plan as are traditional IRA plans.

While high-income individuals are generally limited to traditional IRA accounts, there is a way around the rule with a Roth IRA conversion. You will be required to pay taxes on the amount, since you deducted the contribution for the traditional account, but the idea provides a “back-door” way of getting the tax benefits in a Roth IRA.

In fact, when the IRS removed the income limit on Roth conversions in 2010, conversions surged 800% to $64.8 billion. That year was the first time that conversions exceeded contributions and 57% of conversions were from people with six-figure incomes.

Funding your Roth IRA

Opening and funding a Roth IRA account is fairly easy and similar to opening any financial account online or through a broker. Most online brokerage firms offer retirement accounts and will guide you through the process.

The most important idea here is to avoid paying higher fees where possible, whether funding your account or in regular trading. There will be some fees for opening and maintaining an account, financial institutions have to make something for providing the service, but you should compare fees at several brokerages before opening an account.

- If you are not going to be regularly buying-and-selling retirement investments in your Roth IRA account, and you generally shouldn’t daytrade in a retirement account, then you will want to choose a broker that does not charge inactivity fees.

- If you will be trading a little more frequently, choose an account with lower transaction fees.

- Be cautious of fees charged on mutual funds including administration, redemption and 12b-1 fees. These fees can add up even if you are not buying and selling out of individual funds. If you are comfortable investing in exchange traded funds (ETFs) then there are often many available to mimic the performance of a mutual fund without the high fee schedule.

Funding a Roth IRA account is directly through a check or transfer from an existing financial account or through a conversion of an existing retirement plan. The direct method is the easiest and involves no tax consequences.

Remember that, while Roth IRA conversions do not have an annual limit, your regular contributions are limited to $5,500 annually or $6,500 if you are 50 years or older.

Roth IRA Conversions

Funding your Roth IRA through a conversion of an existing retirement account is more complicated but no less an option. In fact, converting an existing account can be a great way to get access to the tax benefits of a Roth IRA if your income is above the limit set by the government.

You can convert traditional IRA accounts or 401(k) accounts from an employer into a Roth IRA account. There are no income limits to converting existing accounts into a Roth IRA account and there is no limit to how much you can convert. Since you likely took the tax benefit by deducting the contribution from your current year income, you will need to pay taxes on any money you put into your Roth account.

You will want to plan your tax burden when making a Roth IRA conversion. The money that comes out of your traditional IRA or 401(k) account and into the Roth account will go on your taxes as income in the year converted. That may put you into a higher tax bracket depending on your current year income and any other investment gains.

There are two ways to manage a Roth IRA conversion:

- Ask your current retirement plan administrator to transfer the money directly to your Roth IRA account, whether it is with the same company or not.

- Have your current plan administrator send a check to your bank account. You then have 60 days to transfer the money to your Roth IRA account to avoid withdrawal penalties.

IRA Withdrawal Rules

IRA Withdrawal Rules

While withdrawal from your IRA generally has less rules than getting money out of a traditional retirement account, there are still some rules you’ll need to know to avoid the 10% early withdrawal penalty.

- You can withdraw you contributions at any time without paying taxes or a penalty but you may not withdraw earnings before age 59 ½

- Even if you are over the age of 59 ½, you may only withdraw earnings on contributions after they have been in the account for five years to avoid paying the penalty

- Withdrawals may also avoid penalty under conditions of death or disability

- Up to $10,000 may be withdrawn, penalty-free, from a Roth IRA account to pay for the purchase of a first home

- You may be able to avoid the early withdrawal penalty if you have unreimbursed medical expenses exceeding 7.5% of your adjusted gross income or to pay for medical insurance premiums after losing your job

- Withdrawals to cover payments for college expenses for yourself, spouse, children or grandchildren may also avoid the penalty

Tax laws change and you should always check the IRS website, Publication 590 on Individual Retirement Arrangements, before making decisions that could affect your tax liability.

7 Most Common Roth IRA Questions

Does it matter what time of year I contribute to a Roth IRA?

There are pros and cons to when you contribute. If you are paying estimated taxes, you will need to pay taxes on the amount sooner than April of the following year. Paying early means you have more time to change your mind, until October 15th of the following year, if you decide to take the money back.

Waiting until later in the year means you’ll know what your tax bill is going to be with a little more clarity. This makes it easier to plan around a Roth IRA conversion or contribution.

Can I contribute to both a Roth IRA and a Traditional IRA?

Yes, you can contribute to both and it makes sense to diversify your tax burden in retirement. Your combined contributions cannot exceed the maximum limit for your age.

What are the rules to withdraw Roth IRA money tax-free?

All “qualified” distributions from your Roth IRA are tax-free if they satisfy the following requirements:

- Money has been in the account for at least five years and you are older than 59 ½

- You have become disabled or the money is being passed through an estate

- You are using up to $10,000 towards the purchase of your first home

Will I owe state taxes on my Roth IRA conversion?

Generally, your Roth IRA conversion will be a taxable event in your state as well. If your state has an income tax, then you will likely owe taxes on the amount. Since every state’s income tax laws are different, you should consult an advisor before you make the conversion.

Can I undo a Roth IRA conversion and why?

The process for undoing a Roth conversion, moving money back into your traditional IRA account, is called a “recharacterization,” and there are a few reasons it might make sense.

- If your taxable income turns out to be much higher than you estimated, your Roth conversion could result in a larger tax bill.

- You might not have the money to cover your tax bill

- Your may decide that your tax rate in retirement will not be high enough to make a Roth IRA worth it. (I would argue against this one because no one really knows future taxes with any certainty.)

A recharacterization needs to be done before the last day to file or refile your prior year taxes, usually October 15th. If you do a recharacterization, you can move the funds back to a Roth IRA for the next tax year or 30 days after the move, whichever is later.

How do I estimate my taxes if I am planning a Roth IRA conversion?

The easiest way to estimate taxes and avoid any Roth IRA conversion problems is to wait until after the end of the year to make the conversion. You can convert funds up to April 15th for the prior year. This means you can fill out your tax forms and see exactly how a conversion will affect your taxes for the prior year.

Do I have to convert all of my existing retirement account to a Roth IRA?

No, you can convert as little or as much from an existing account to a Roth IRA. There are no income or contribution limits. You will be taxed on the conversion though so you may want to contribute only the amount that will keep you within the same federal tax bracket.